A Title Loan for Multiple Vehicles offers quick cash with less stringent requirements but carries high-interest rates and risk of repossession. Explore alternatives like traditional loans from banks or credit unions for more flexible terms before committing to this option.

Considering a title loan for multiple vehicles? This guide will help you make an informed decision. First, we’ll demystify these loans: what they are and how they work. Then, we’ll balance their benefits—like quick access to cash—with potential risks, such as high-interest rates. Finally, we’ll explore alternatives, ensuring you’re aware of all borrowing options before committing.

- Understanding Title Loans for Multiple Vehicles

- Benefits and Risks of This Lending Option

- Exploring Alternatives: Other Ways to Borrow

Understanding Title Loans for Multiple Vehicles

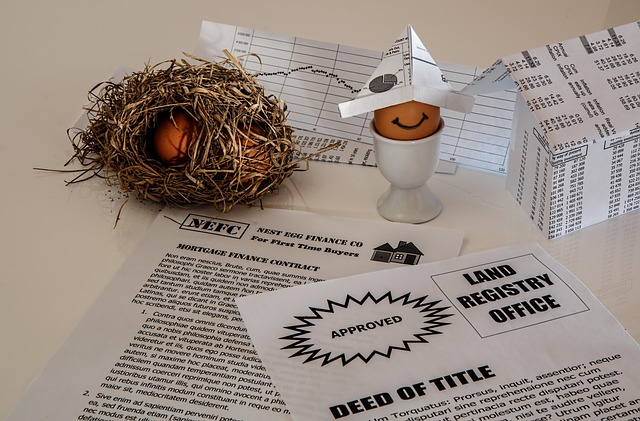

A Title Loan for Multiple Vehicles is a financial option where individuals can borrow money using the titles of their vehicles as collateral. This type of loan is designed to offer flexible access to capital, especially for those who may not qualify for traditional bank loans due to poor credit or lack of collateral. It’s an attractive prospect for many, providing a quick and easy way to secure financial assistance without the stringent loan requirements often associated with other lending methods.

These loans are ideal for those who own multiple vehicles, as they can use each vehicle’s title separately. This means you could potentially access funds from different cars, offering greater flexibility. Unlike some loan options that conduct extensive credit checks, Title Loans often do not require a thorough credit check, making them accessible to a broader range of individuals. However, it’s crucial to understand the terms and conditions, including interest rates and repayment periods, before committing to such a financial decision.

Benefits and Risks of This Lending Option

A title loan for multiple vehicles can offer a unique set of advantages and potential drawbacks that borrowers should carefully consider. One of the primary benefits is accessibility; this lending option is available to individuals who may not qualify for traditional loans due to poor credit or lack of collateral. It provides a quick way to access cash, often with quick approval, making it an attractive solution for those needing emergency funds. Borrowers can use multiple vehicles as collateral, allowing them to borrow a substantial amount in one go, which is ideal for unexpected expenses or financial emergencies.

However, there are risks associated with this type of loan. The primary concern is the potential for a cycle of debt due to high-interest rates and short repayment periods. If not managed responsibly, it can lead to borrowers being unable to pay back the loan on time, resulting in additional fees and even the risk of losing their vehicles through repossession. It’s crucial to understand the terms and conditions thoroughly, especially regarding interest rates, repayment schedules, and potential penalties, before opting for a title loan for multiple vehicles as a cash advance solution.

Exploring Alternatives: Other Ways to Borrow

When considering a title loan for multiple vehicles, it’s crucial to explore alternatives first. Traditional lenders often offer more flexible loan terms and competitive interest rates, especially if you have good credit. These options typically require collateral, but they might not place as much emphasis on the specific vehicle type or condition as title loans do.

Additionally, checking your loan eligibility with multiple institutions can open doors to better deals. Many banks and credit unions provide personal loans or home equity lines of credit that could be more suitable, depending on your circumstances. Moreover, some online lenders specialize in alternative financing options. Before settling on a title loan, assess these possibilities and consider factors like interest rates, repayment periods, and the overall borrowing process to find the best fit for your needs, especially if you own multiple vehicles.

When deciding if a title loan for multiple vehicles is the right choice, it’s essential to weigh both its advantages and potential drawbacks. While it offers quick access to cash with less stringent requirements compared to traditional loans, there are significant risks involved, including high-interest rates and the possibility of losing your vehicle if you default. Exploring alternatives like personal loans or credit cards could be more favorable options, providing better terms and avoiding the risk of collateral loss. Before making a decision, thoroughly consider your financial situation and seek professional advice to ensure you choose the most suitable borrowing method.