Online title loans for multiple vehicles offer quick funding with less stringent credit requirements. Streamlined applications assess vehicle value for approvals, providing flexible repayment terms and refinancing options. When comparing, focus on interest rates, repayment periods, equity evaluation, and fine print to avoid hidden fees. The online application process requires detailed vehicle and personal information for eligibility assessment and fair loan offers based on criteria alignment.

Looking to compare title loans for multiple vehicles online? This guide breaks down everything you need to know. From understanding the unique benefits of these loans, to mastering the art of comparing offers effectively, and navigating the entire process smoothly – we’ve got you covered. Discover key factors that separate top lenders from the rest, and take control of your financial needs with confidence.

- Understanding Title Loans for Multiple Vehicles Online

- Key Factors to Compare Offers Effectively

- Navigating the Process: From Application to Approval

Understanding Title Loans for Multiple Vehicles Online

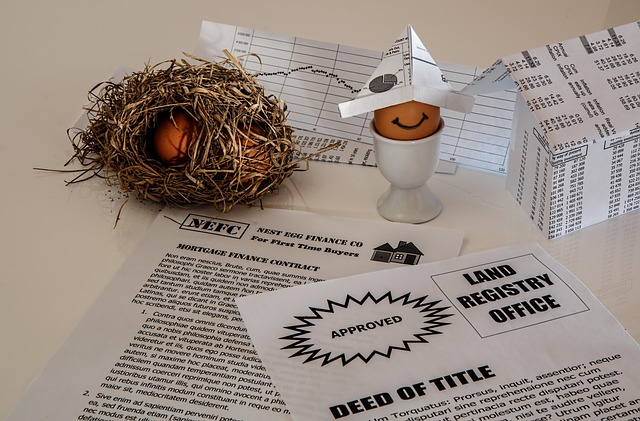

Online Title Loans for Multiple Vehicles offer a convenient and quick solution for borrowers looking to access cash using their vehicle’s title as collateral. This type of loan is designed for individuals who own multiple vehicles and want to leverage their equity for immediate financial needs. Unlike traditional loans, these online options often have less stringent requirements, allowing borrowers to apply with faster approval times, even if they have poor credit or no credit history.

The process involves applying for a loan through an online platform, where lenders assess the value of your vehicles and offer a cash amount based on their worth. One significant advantage is the flexibility in repayment terms. Many lenders provide various payment plans tailored to different borrower preferences and financial capacities, including flexible payments that align with your schedule. Additionally, borrowers have the option to refinance their existing loan to secure better rates or terms, making it an attractive choice for those seeking more adaptable financing solutions.

Key Factors to Compare Offers Effectively

When comparing offers for a title loan on multiple vehicles online, several key factors come into play. Firstly, assess the interest rates offered by different lenders, as these can vary significantly and impact your overall cost. Each lender will have their own set of terms and conditions, so understand the repayment period options available and choose one that aligns with your financial capabilities and goals. Consider whether you are looking for a short-term solution or a more flexible option through loan refinancing or extension later on.

Additionally, evaluate the value placed on your vehicle’s equity, as this will determine the loan amount you can secure. Lenders use vehicle equity to mitigate risk, so shop around to find offers that consider your specific vehicle’s make, model, and condition fairly. Keep in mind that while online platforms offer convenience, reading through the fine print is essential to avoid hidden fees or terms that could prove detrimental to your financial health.

Navigating the Process: From Application to Approval

Navigating the process of obtaining a title loan for multiple vehicles online involves several steps, each designed to streamline the application and approval procedure. It begins with the submission of an Online Application, where potential borrowers provide detailed information about their vehicle(s), financial history, and personal data. This digital approach not only saves time but also allows lenders to quickly assess loan eligibility based on predefined criteria.

Upon receiving the application, lenders perform a thorough evaluation. They examine the provided documentation, verify details, and determine the overall loan amount offered. The key factor here is ensuring that the vehicle(s) meet the required standards for collateral and that the borrower’s financial situation aligns with the cash advance terms. This meticulous process aims to provide a fair and accessible solution for those seeking multiple-vehicle title loans, offering a convenient alternative to traditional lending methods.

When considering a title loan for multiple vehicles, understanding your options and comparing offers is key. By evaluating factors like interest rates, repayment terms, and the overall transparency of lenders, you can make an informed decision. The online process streamlines this, allowing you to explore various offers efficiently. Remember, meticulous comparison ensures not only securing favorable terms but also receiving the best value for your vehicle’s title.